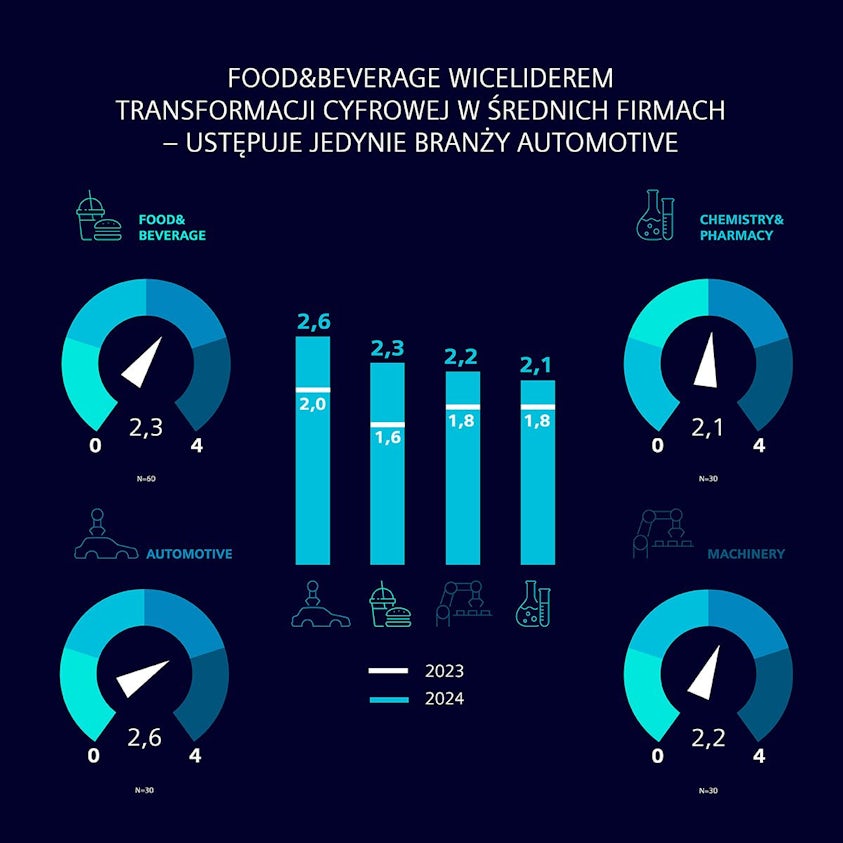

Spectacular acceleration in one particular sectorThis year's Siemens Digi Index report indicates an increase in the digital maturity of medium-sized manufacturing enterprises. Measured on a 4-point scale, the Digi Index rose from 1.8 to 2.3 year-over-year. A significant contributor to this growth was the spectacular leap in the food sector, which shows that this industry is undergoing an intensive transformation. In the case of large companies, there was a slight correction - from 2.7 to 2.5. The survey results were commented on by experts from various sectors, including Professor Jerzy Hausner and Paweł Chaber from PARP, who analyzed the opportunities and challenges facing Polish companies on their path toward Industry 4.0.

Digi Index 2024 available for download

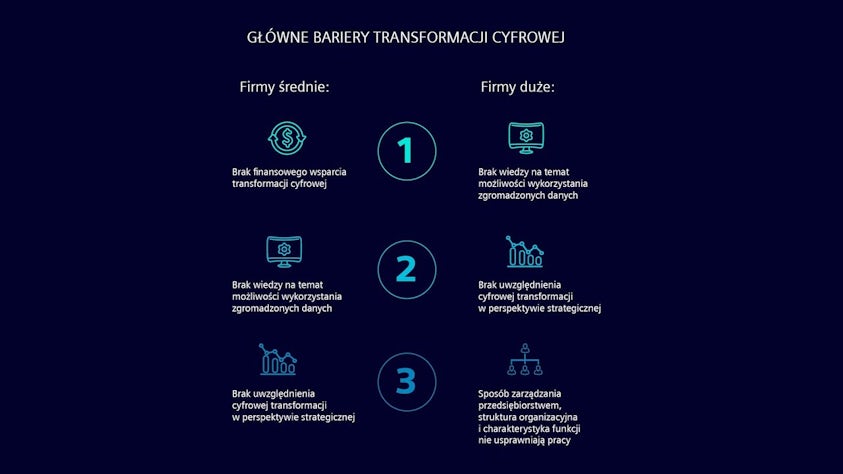

Siemens has conducted the fifth edition of its study on the level of digitization among medium-sized manufacturing enterprises in the following sectors: Food & Beverage, Chemistry & Pharmacy, Automotive, and Machinery. For the second time, large enterprises (>250 employees) were also included in the study.The Digi Index serves as a barometer of technological awareness among decision-makers and managers in Polish manufacturing companies.This year’s index value for medium-sized companies reached 2.3, significantly higher than the previous year. This is largely due to a rapid acceleration in the food sector.The study revealed that companies are allocating increasingly larger budgets to digital development - in 2024, nearly 28% of their budget, which is 2.5 times more than the previous year.The biggest challenges remain financing digitization, data management, and a strategic approach to transformation.

Digi Index 2024 report available for downloadThe Digi Index is an annual study conducted for the past 5 years by Siemens Polska in cooperation with the research institute Keralla Research. Its aim is to determine the current level of digitization among manufacturing enterprises in Poland operating in four sectors: Food & Beverage, Chemistry & Pharmacy, Automotive, and Machinery. The level of digitization (expressed through factors such as management awareness of the importance and role of this area in business operations, the degree of production digitalization and data usage, and the state of investment in new technologies) is fundamental to achieving the goals of Industry 4.0 and smart manufacturing. Based on the collected responses, the Digi Index is calculated on a scale from 0 to 4. The higher the value, the greater the digital maturity of enterprises in a given area and the more fully they realize the vision of Industry 4.0. In 2024, the index value for medium-sized companies increased significantly, recovering from last year’s decline (1.8 in 2023). The result of 2.3 is the second highest in the history of the study. For large companies (>250 employees), a slight correction was noted - from 2.7 last year to 2.5 this year.

A positive surprise Since the beginning of Siemens' research, the Automotive sector has stood out with an exceptionally high level of digitization compared to the other analyzed industries. With a score of 2.6, it once again leads this year. This time, however, it is closely followed by a sector previously considered the main laggard in transformation processes. The result of the Food & Beverage sector, which made a clear rebound (from 1.6 to 2.3 year-over-year), is a positive surprise. Growth - though not as spectacular - was also recorded in the Machinery sector (from 1.8 to 2.3) and the Chemistry & Pharmacy sector (from 1.8 to 2.1).Siemens' study shows that digitization of manufacturing companies in Poland is accelerating. All sectors recorded not only an increase in Digi Index scores but also (and perhaps most importantly) an increase in spending on digitization. This year, companies decided to allocate nearly 28% of their profits to this purpose - 2.5 times more than last year (11.17%).

A unique opportunity Thanks to the recently launched pool of EU funds, Poland has a chance to significantly accelerate its digitization processes. To make good use of this opportunity, a holistic, long-term digitalization plan is essential. A comprehensive transformation strategy requires a multi-level approach - from technological infrastructure and IT/OT system integration, through effective data management, to the development of digital skills and organizational culture. “Polish industry cannot afford to miss this unprecedented opportunity,” says Maciej Zieliński, CEO of Siemens Polska.

A particularly spectacular increase in the food sector confirms a major shift in awareness The sharp rise in the index within the food sector confirms that a significant change in the awareness of Polish entrepreneurs has taken place over the past 12 months. “A high Digi Index score is a positive signal for the entire sector, which in the past lagged behind other industries and its counterparts in Western Europe. The digital transformation of the Food & Beverage (F&B) sector is crucial for its competitiveness in both domestic and international markets, as well as for enabling its sustainable development,” says Agnieszka Maliszewska, Director of the Polish Chamber of Milk.

The wind of digital change For medium-sized companies, the year 2024 brought growth in virtually all components of the Digi Index (i.e., results in the individual areas studied). The most visible increase was in the area of strategic planning (although it remains one of the weaker-performing parameters), but also in organization and administration, and the application of digital processes. Significant changes are also noticeable in the level of advancement of digitization processes. Nearly twice as many companies (7.3% compared to 4% year-over-year) declare that the degree of digitalization in their enterprise exceeds 80%. Moreover, over 30% of surveyed medium-sized companies declare that their budget for digitalization will increase. “The Digi Index value of 2.3 points is a positive growth signal indicating an intensification of transformation efforts. (…) The increase in the number of companies that assess their level of production digitalization above 60% means that these organizations recognize the benefits of implementing advanced digital tools, such as automation systems, data analytics, or real-time process management. This year’s report results are a signal that medium-sized Polish manufacturing companies are on the right track, but the pace of change must be faster to meet growing market demands,” says Paweł Chaber, expert at the Department of Analysis and Strategy at PARP.

A small step back for large companies Last year, the Digi Index study included large companies (>250 employees) for the first time, whose level of digitalization turned out to be generally higher than that of medium-sized firms. This year’s slight decline in the score - from 2.7 to 2.5 year-over-year - is due to several factors (besides statistical margin), such as cautious investment moves in response to geopolitical instability. Nevertheless, the undisputed digital leader remains the Automotive sector, with an impressive score of 3.2 points. “As the Automotive sector is undergoing a very deep energy and digital transformation, it seems that the Polish automotive industry is adapting to the changing reality, among other things, by accelerating the digitization of production processes. (…) Entrepreneurs in this sector understand that there is no turning back from implementing digital technologies in the automotive industry. In the context of global competition, this is a decisive factor for survival. Whether the automotive industry remains the driving force of the European and Polish economy will depend on its ability to adapt to changes within the fourth industrial revolution and to reach the level of global leaders also in terms of production process digitalization,” says Paweł Wideł, President of the Association of Automotive and Industrial Goods Employersat Confederation Lewiatan.

Priorities of the giants Despite slight declines, data management remains one of the strongest areas for large companies, along with digitized production and operational activities. This translates into higher efficiency, greater security, process optimization, and cost savings.

The key role of strategic thinking This year's Digi Index survey results show that for both medium-sized and large enterprises, a strategic approach to the digitization process remains a major challenge.

The key role of strategic thinking “The survey results clearly indicate that the most significant weakness of Polish enterprises - apart from financing issues - is the lack of a strategic approach to digital transformation. (…) This affects the fact that companies, despite increasing spending on digitalization, struggle with integrating their own information systems. When analyzing the survey results regarding the benefits of digitalization indicated by respondents, it is noteworthy that they much more frequently point to motives related to broadly understood efficiency (higher productivity, process optimization, cost savings) than to motives related to the long-term development of the company (possibilities of implementing innovative solutions, new business models, product quality, sustainable development),” comments economist Prof. Jerzy Hausner. “Unfortunately, this condemns them to imitative adjustments to conditions defined by other players. And it confirms both the deficit - and the high importance - of a strategic approach to digital transformation, which still requires a lot of attention and work,” he adds.

Download Digi Index 2024 to learn even more about the digitalization of Polish enterprises in 2024

Digi Index – methodology: The study was developed by the Keralla Research Institutecommissioned by Siemens Sp. z o.o.. It was conducted across Poland using the CATI method among companies actively operating, excluding entities in suspension or liquidation bankruptcy. The study is quantitative, based on a nationwide sample with random-stratified selection: N = 150 manufacturing companies employing 50–249 people and N = 30 large manufacturing companies employing at least 250 people.

Contact: Marta Benedyczak +48 538 554 054 marta.benedyczak@siemens.com Website: https://www.siemens.com/pl LinkedIn: https://www.linkedin.com/company/siemens Send email